Posts

The bucks will be placed to your membership no matter where you make the new deposit. – The new each day detachment limit from the an excellent Pursue Atm is $500 for many profile, however it may differ depending on the type of membership your provides. No, inspections that are past its termination day are not approved to own mobile put. Maintain the unique seek out at least 60 days otherwise up to you have got affirmed your finance had been securely paid to help you your bank account. No, 5th 3rd Financial cannot enable it to be people so you can put an identical consider because of numerous procedures.

Appel d’urgence

Chase doesn’t have a certain limitation to your level of mobile dumps you possibly can make overnight. Although not, there is limitations to your complete number of places your can make in one day. Chase cannot already service dumps of money utilizing the mobile software.

What is the Earnings Restriction To possess Environment To own Mankind

When deposit dollars in the a TD Financial Atm, you’ll receive a circulated bill confirming the fresh deposit. It is very important bare this bill for your details, in the event of one inaccuracies together with your deposit from the upcoming. Expert marble-including table-passes, taking layout and you may longevity for your cooking escapades.

Make sure to double-take a look at all the details prior to submission in initial deposit to quit people mistakes. Yes, Dollars Application makes you import currency to many other Bucks App pages and to additional bank account. Merely enter the receiver’s information and you will follow the to the-monitor recommendations to accomplish the newest transfer. In order to withdraw funds from your hard earned money Application membership, you might transfer fund in order to a linked family savings or debit cards. Just stick to the for the-display tips on the Bucks App to help you start a withdrawal. Specific banks have long hours, while some would be restricted to simple regular business hours.

- Merrill Lynch typically urban centers a hold on tight mobile dumps to confirm the brand new authenticity of your own take a look at and ensure one to enough finance are offered.

- But not, it is very important note that the money deposit limit however can be applied.

- Chase will not already help deposits of 3rd-team inspections with the cellular software.

- You can deposit any combination of bills for as long as they cannot surpass the new everyday and you may month-to-month limitations.

- You will need to understand daily limitations to have dollars places and also to song the purchases to make sure you sit during these constraints.

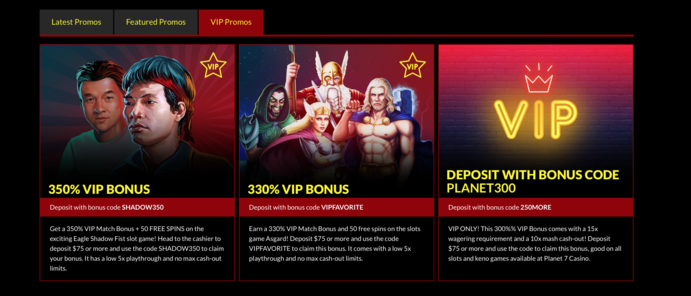

Totally free spins or any other extra also provides also come you to definitely features certain legislation, which are constantly obviously told you underneath the provide. For this reason, it is important to consider for each and every promo and make certain you can see the requirements before plunge in to the. Internet casino incentives usually are incentives supplied by playing websites to the fresh and you may for the last users.

Eating Stamp Money Limit Missouri 2025

If you wish to put over $5,100000 immediately, you can travel Learn More Here to a department place to improve deposit in the people. This permits one to deposit big quantities of currency without getting simply for the new mobile deposit each day restriction. A safe deposit package, possibly called a defensive deposit box, is actually a secure, closed container kept in this a more impressive container, typically inside a federally covered bank otherwise borrowing union. The primary reason for this type of packets should be to offer an exclusive and you can safeguarded place for folks to store rewarding points and you will important documents. No, post-old monitors cannot be deposited having fun with Synchrony Lender’s mobile deposit function. Yes, Synchrony Bank’s mobile deposit element uses state-of-the-art security features to safeguard people’ painful and sensitive economic advice.

Can you imagine that person to the $90 within pocket place it inside their checking account? Well, the bank manage continue 10% of it, and you will provide out the almost every other 90%, identical to it did along with you, carrying out some other increase of the latest money in other people’s pocket. So we will keep taking place that it bada-increase bunny hole until we are able to’t go any farther. This is what the newest main bank tries to guess and manage thru monetary policy. Thus, account on the large APYs and you can reduced limitations and charges ranked higher for the all of our list. You might decide on the Varo’s savings apps, including Keep your Change (the fresh application’s roundup feature) and you may Save your Shell out (the new automated salary transfer system).

5th 3rd Lender also provides a convenient cellular financial app that allows users to help you deposit inspections from another location making use of their cellphones. That is a convenient replacement Automatic teller machine dollars places to own people that like to create its financial on the run. BMO Harris Bank could possibly get place a hold on tight fund deposited as a result of the internet take a look at put element. Which keep is generally placed for just one-2 working days to ensure the fresh look at clears before money are built offered to the customer. To help you be eligible for our very own listing, the institution must be federally covered (FDIC for banking institutions, NCUA to have borrowing unions), and the account’s lowest initial put should not go beyond $twenty-five,one hundred thousand. Moreover it usually do not establish a maximum deposit count which is lower than $5,one hundred thousand.

MCU (Civil Credit Union) isn’t any exclusion, providing its players the handiness of cellular take a look at deposit. On this page, we will talk about MCU’s cellular view put limit, offer interesting things, and you will answer some common issues related to this particular feature. Let’s state you have a check to possess $fifty,100 that you want so you can put by using the cellular put feature to the Merrill Border app. Because the cellular put restriction is actually $one hundred,one hundred thousand per day, you can put an entire amount of the new consider with no things.

What are the results For many who Discuss Their Credit limit Pursue

Which preserves some time and eliminates should make a supplementary stop by at the bank. Sure, users can be deposit inspections on the web playing with Financial out of The united states’s cellular app otherwise on line banking platform whether or not he could be outside the Us. Should they get access to the web, they could deposit monitors from anywhere global. Money from a transferred online in the Bank out of The united states are normally available within one in order to a couple business days. However, which schedule may differ with regards to the number of the fresh consider plus the customer’s membership background. Let’s state we should put a to have $step 3,100000 using the cellular deposit element at the Vystar Borrowing Relationship.

Searching Credit card Increase Restriction

However, remember that their wireless provider may charge analysis or almost every other fees for using the brand new mobile financial software to make dumps. It’s usually a good idea to test with your supplier to own any possible costs. If you would like put more than the new everyday or monthly limitations enable it to be, you could potentially get in touch with Chase Financial in order to demand an increase in your cellular deposit restriction.