Articles

The Gladiator $1 deposit brand new set aside ratio enhanced by cuatro foundation issues in the next quarter to one.21 per cent that is ten base points greater than a year back. The last graph shows that DIF balance try $129.2 billion to the June 31, 2024, upwards as much as $3.9 billion in the very first one-fourth. Assessment money always been the key driver of one’s increase, including $step 3.dos billion to your DIF balance. Desire attained to your financing ties and you will bad specifications for insurance losses and shared a combined $1.step 3 billion to help you growth in the newest money, partially counterbalance because of the working expenditures of $609 million. Next chart means that residential places decreased $197.7 billion, or step one.one percent, within the next one-fourth, beneath the pre-pandemic mediocre next quarter development of 0.dos %.

The brand new disallowance laws doesn’t apply at a qualified conservation contribution from a household admission-thanks to organization. A household solution-thanks to organization are a partnership otherwise S business in which 90% or higher of your own passions take place because of the an individual and loved ones of such individual. For those motives, members of one’s members of the family will be the private’s companion and folks explained within the area 152(d)(2)(A)-(G).

UOB repaired put rates: Gladiator $1 deposit

As well, 15 percent money back try gained to your qualifying debit card purchases. A little distinct from almost every other name places, the newest ANZ Get better Observe Name Deposit enables you to secure an excellent high interest rate in exchange for taking 29 months’ improve see if you want to withdraw finance through to the stop of your identity. It’s a terrific way to create that cash you wear’t must availability to the quick notice, work actually more difficult. But bear in mind charges and you can charges tend to sign up for early withdrawals and the membership often happen an attraction loss of regard of your money withdrawn or transported very early. Excite refer to the new ANZ Saving & Purchase Things Fine print for further suggestions.

Prepare yourself to place your considering limit to the and you may mention it humorous listing of money riddles! This type of funny riddles and cash conundrums are designed to provide a enjoyable challenge for your mind and you may intellect. This one now offers SDCCU people a lot more independence and you may balance compared to the other conventional offerings.

NerdWallet’s Finest Bank Incentives and Advertisements from April 2025 (as much as $step three,

- While we recall the prior, we have to also consider the new lessons they imparts.

- Residents get in it by the volunteering in numerous positions to simply help tailor and you may collect the brand new set, along with jobs for example folding, packing, and you may work for those who may not know how to sew.

- Yet not, if the contributed house is included in farming or livestock production (or perhaps is designed for such as creation), the brand new sum should be susceptible to a regulation that the assets continue to be available for such creation.

- One another deals and you can exchange deposits declined from the previous quarter, with development in small time places partially offsetting the new declines.

Loan providers try next rated to your some things, culminating inside a celebrity score from a single so you can five. San diego Condition Borrowing Connection (SDCCU) has firmly centered in itself as the a trusted lender along the many years. Featuring its varied mortgage items, unwavering dedication to customer support, and you will strong community sources, SDCCU stays a premier option for of several within the southern area California. SDCCU’s certification try relatively quick you need to include a small down payment lowest and you may jumbo loan alternatives to your each other varying and you will repaired-price mortgage choices.

Inside COVID-19 pandemic, the new Reddish Mix said the dearth away from contributions got attained a great drama. Yet not, the brand new FDIC suggests you to definitely associations complete their Call Declaration to have Summer 29, 2024, just before filing the fresh SOD survey, make it possible for evaluations out of put totals between the two account. The next internet adaptation is modified November 1, 2023 to incorporate suggestions for associations one to incorporate FedCash Elizabeth-Reveal Provider.

Finest Examining Incentives and you will Checking account Also provides

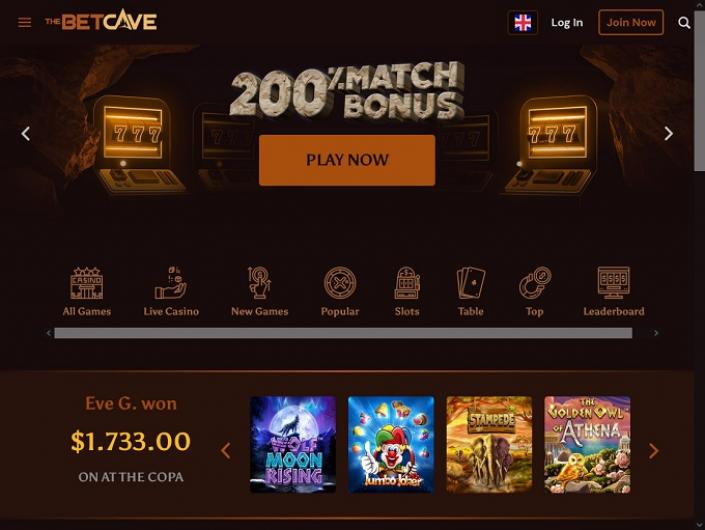

It can be an easy task to get caught up in the enjoyable; don’t choice money you’re also unwilling to get rid of. Which have Sweeps Gold coins game, whether or not, you can redeem certain profits for cash awards. Come across much more about the best a real income harbors on the internet and you will sample a number of ports less than. This means you aren’t guaranteed to winnings 99% of the money you spend so you can a slot back to anyone example.

- See ANZ Preserving & Deal Points Conditions and terms (PDF) to find out more from the ANZ’s costs and you will charge.

- The entire Checking financial extra is amongst the better available checking account incentive also provides offered.

- Days for females is consistently seeking to assistance from the neighborhood.

- Never assume all Environmentally friendly Mark merchants undertake bucks places, and those that perform get impose a fee of up to $4.95.

Giving blood the most nice stuff you can also be create, also it doesn’t capture long after all. If you can contribute more often than once per year, you’ll gamble a serious role in keeping the world’s blood circulation stable. For many who’lso are trying to find donating bloodstream, browse the conditions and you will discover more about the process to learn what to anticipate. Thanks for your own need for applying for a decreased-rate credit card from SDCCU.

You can expect your payments to reach on the membership within the 1-5 days most of the time. Some distributions, specifically, larger of those get interest tax conformity. The best experience to utilize an excellent debit otherwise bank card, you could as well as put through an age-handbag. Realize your selected casino’s percentage small print to learn more in the commission actions. You might lawfully play during the real money online casinos in the Connecticut, Delaware, Michigan, Nj-new jersey, Pennsylvania, and you will West Virginia. And the aesthetics away from digital slots, for each games also provides an array of incentives, payment proportions, go back to athlete (RTP) ratios, and you can volatility.

Some game allow you to pick usage of certain incentive has, which is an instant track to a few of the most important gains on the game. Extremely online slots games ability easy game play nevertheless the laws and regulations may differ drastically. Along with, know that legitimate position internet sites stop pages lower than decades 18. The enormous (and you may expanding) assortment of the newest slot websites and game styles can add the brand new variations on the laws and regulations.

Pentagon Government Credit Union

All slot internet sites will need a global member username and passwords, which may just were a good username and a code. Enter in a different username and you will exclusive code and also you’re in route. Note that real money websites will require considerably more details which may were an address, authorities ID, public security number, and percentage guidance. Prior to taking a chance on a single of the a huge number of on line slots, is a demonstration. Most top real cash online slots has a free of charge-to-enjoy type to experience prior to people genuine-currency revolves. That have a 50,000x max victory available, Huge Flannel is actually a casino game you might’t ignore for many who’re searching for larger gains while playing online slots games the real deal money.

“The newest facility in itself gives us choices for apps beyond everything we have the ability to render during the OLMP. I wear’t provides a prescription drinking water hook up-up and we have water drainage concerns from the partial bit out of road ahead of the school. Having information between inclusion and you will discrimination to your misinformation epidemic, in 2010’s Faith and you may Ageing Appointment served while the a powerful note of the challenges i deal with and the actions we could test create positive transform. The initial presenter is actually Timothy Caulfield, that is a professor out of fitness, law and technology policy and you may a just-attempting to sell author.